Investment Market Update 20.03.2020

As you know, financial markets continue to be extremely volatile during these unprecedented times and I wanted to drop you a quick note. The majority of UK individuals with pensions and/or investments will have seen some large falls in their values and quite understandably may have concerns and questions as to whether action is needed.

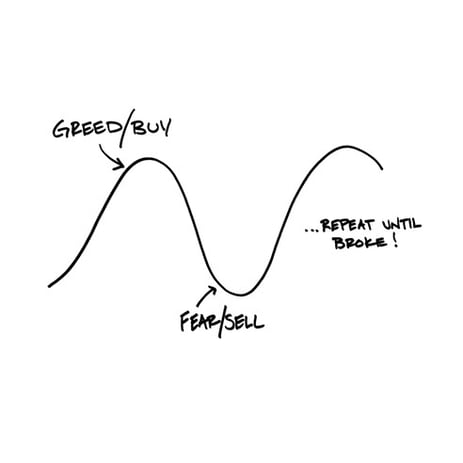

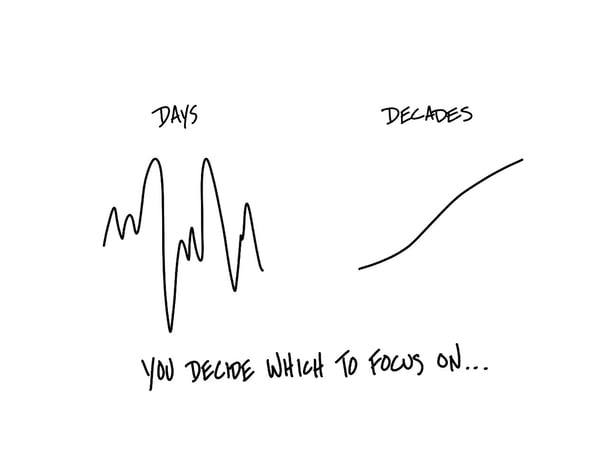

Historically we have seen market crashes and corrections and the data overwhelmingly supports the theory of “time in the market” rather than “timing the market.” Some investments experts believe they can identify the opportune moment to buy or sell during such periods of volatility but we believe that this adds additional risk at the wrong time. To stop further falls, you could sell your investments and move to a safer cash environment but in doing so you would crystallise recent losses and potentially miss out on the recovery stage.

If you are making regular monthly contributions then the stock market is currently ‘on sale’ and you are buying at a discount compared to a month ago.

Without being able to predict the future we suggest the most sensible approach is therefore to do nothing and allow the markets to naturally recover. If however you feel you would like to discuss your circumstances in more detail, please do contact us.

Please stay safe by abiding to the Government advice and look after your family and friends.